The Solvent Liquidation Process in Hong Kong Explained

It usually takes seven to 12 months to complete the liquidation of a solvent company in Hong Kong. This is how the process works and why you should consider a Members’ Voluntary Liquidation if the business has fulfilled its purpose or wants to cease trading.

Choosing to liquidate a solvent company that’s no longer of use (a Members’ Voluntary Liquidation - MVL) may not be a task that is a priority to business owners. However, if a business has fulfilled its purpose, it’s important that directors act proactively to resolve and propose that the members appoint a liquidator under the MVL regime to voluntarily wind it up, with capital being returned to shareholders through the redistribution or liquidation of assets.

Doing so can save management’s time, money and effort that would otherwise be spent on the on-going maintenance of a business’ statutory reporting requirements (that are ever increasing) and payment of annual registration fees.

A typical solvent liquidation of a Hong Kong company takes at least seven months to complete if the company doesn’t have any assets or liabilities, or nine months should there be a simple dividend distribution to creditors before a return to shareholders is made. This is the time required to meet various statutory requirements, including giving an adequate window of time for creditors, if any, to come forward.

At Perun, we aim to complete each solvent liquidation efficiently and within 12 months. The main step post-appointment, which determines when the liquidation of a shell company can close, is the obtaining of the tax clearance from the Hong Kong Inland Revenue Department, which usually takes about 2-3 months.

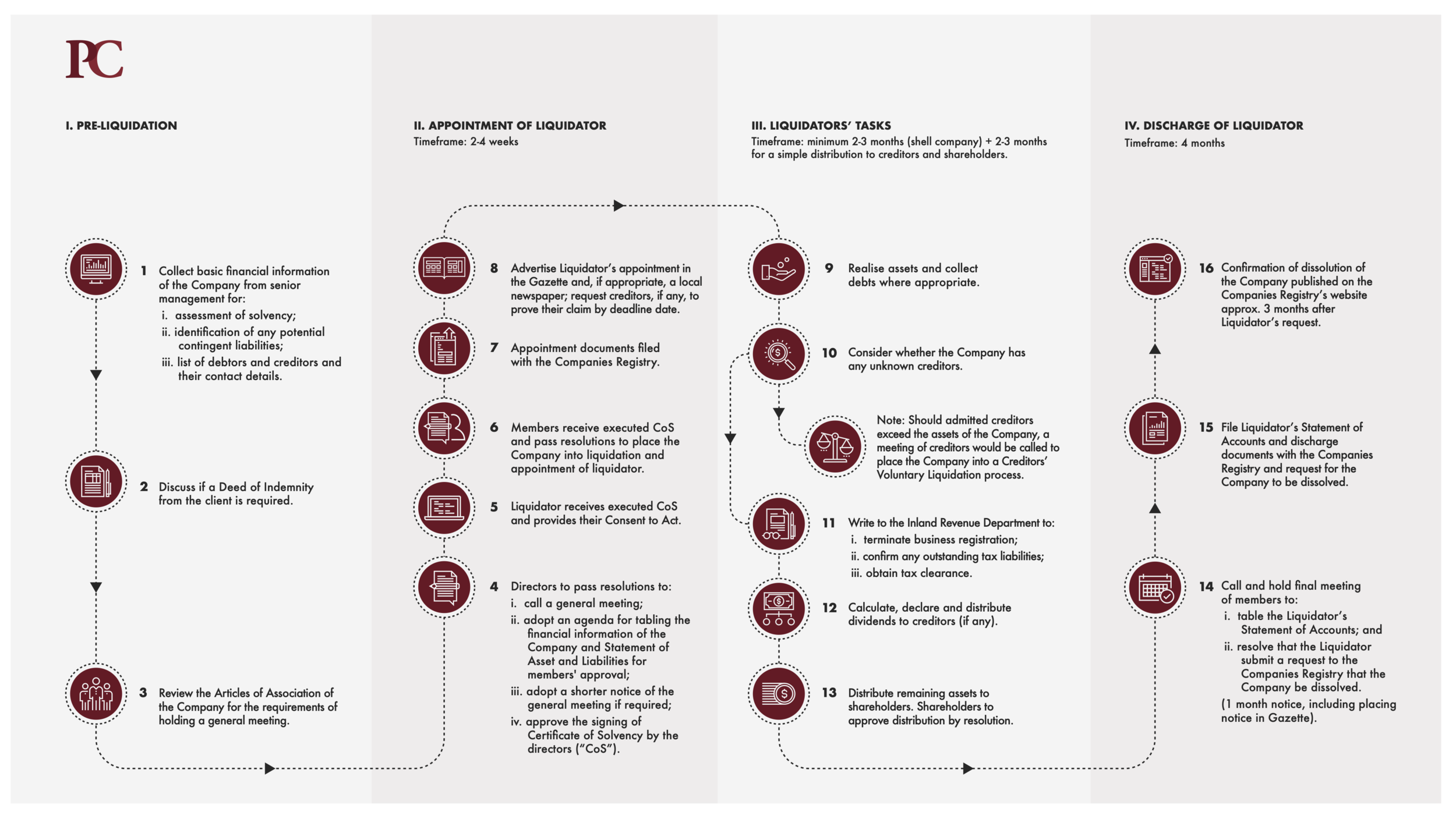

An MVL in Hong Kong is typically a four-stage process:

I. Pre-liquidation

In the first stage of the process, certain data and documents need to be prepared and shared with the proposed liquidator, including basic financial information, potential contingent liabilities and lists of creditors. During this time, we also review the “Articles of Association” to understand the Company’s governing rules that are to be met in order to place the company into voluntary liquidation.

II. Appointment of liquidator

Liquidators are normally appointed within the first two weeks of the members’ general meeting, when the resolution is passed to appoint a liquidator. At this time, directors approve the signing of Form NW1, which is the official Certificate of Solvency (“CoS”). Such executed statements are provided to members and the nominated Liquidator. The CoS, Form NR1 (Notice of Change of Address of Registered Office) and Form NW3 (Notice of Appointment of Liquidator) are then filed with the Companies Registry by the liquidator. A notice of appointment is also placed in the Gazette and a local newspaper if there are creditors involved.

It’s important to note that directors are only involved in the pre-liquidation and appointment of liquidator stages, to help place the company into liquidation. Once the company is in liquidation, it is no longer under the control of the directors, but instead the liquidator, and hence, the company’s directors generally don’t need to be further involved once the liquidator is appointed.

III. Procedures by the liquidator after appointment and before discharge

This part of the liquidation process takes at least two months to complete when dealing with a shell company, and a further two to three months if there is a simple distribution to creditors and contributories. Liquidators will also need time to communicate with creditors and verify “Proof of Debt” claims, and distribute dividends. Once assets have been realised and creditors’ claims have been settled, liquidators will distribute remaining assets to shareholders. The liquidator will also liaise with tax authorities, and file to the Companies Registry its receipts and payments. The time required to complete the liquidation would be extended should there be assets to be collected and realised, depending on type of the asset.

IV. Closing procedures by the liquidator

The final stage in the process takes approximately four months to complete. It includes notifying members of the date of the final meeting of contributories, holding the final meeting and the filing of the following dissolution documents to the Companies Registry immediately after the final meeting: final statement of accounts, Form NW5 (Notice of Cessation to Act as Liquidator) and return of final meeting. The Company will usually be dissolved within three months from the filing of the dissolution documents with the Companies Registry. The dissolved status of the company will be updated and confirmed on the Companies’ Registry website.

Why you should appoint Perun Consultants as your liquidator

It’s important that directors don’t put off starting the MVL process. All you need to do to start it is to appoint us for a fixed fee and we will take care of the rest, and we usually have the process wrapped up within 12 months. At Perun Consultants, we have considerable experience acting as liquidator in Hong Kong, the British Virgin Islands, the Cayman Islands and Singapore and we can provide a one-stop solution as a liquidator of group companies incorporated in these jurisdictions.

If you would like to find out more about our service, please don’t hesitate to call us. You can find all our contact information here.